Social Security Threshold 2025

BlogSocial Security Threshold 2025. The most you will have to pay in social security taxes for 2025 will be $10,453. Filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income.

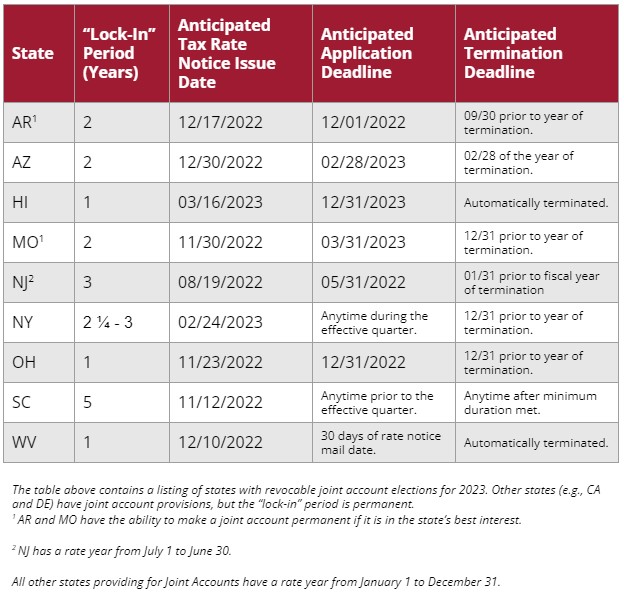

Social security payment of $4,873 to go out this week. Those limits change from year to year, but in 2025, the base limit is $22,320, up from $21,240 in 2025.

The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Keeping Social Security Strong AARP, The limit is higher for those who are legally blind. Beyond that, you'll have $1 in social security withheld for every $2 of.

Are My Social Security Benefits Taxable Calculator, There's no wage base limit for medicare tax. The following social security thresholds are applicable as of january 20241:

2025 Social Security, PBGC amounts and projected covered compensation, Specific coverage thresholds for 2025. The social security contribution thresholds are determined based on the development of all employees' gross salaries that are subject to germany’s social.

Maximize Your Paycheck Understanding FICA Tax in 2025, That’s what you will pay if you earn $168,600 or more. This amount is also commonly referred to as the taxable maximum.

Keep Social Security funded by raising max taxable earnings threshold, For 2025, the supplemental security income (ssi) fbr is $943 per month for an eligible individual and $1,415 per month for an eligible couple. Social security payment of $4,873 to go out this week.

Social Security & Retirement 2025 Working & Receiving Social Security, That’s what you will pay if you earn $168,600 or more. The 2025 threshold amounts were calculated using the 2025 average per capita.

Should I File Social Security Instead of Railroad Retirement, Anyone born between the 21st and 31st of any month will have their benefits paid on april 24. The federal government sets a limit on how much of.

Social Security Planning & Advisor Dave Silver Tampa, Bradenton, The 2025 threshold amounts were calculated using the 2025 average per capita. The federal government sets a limit on how much of.

(PDF) Mobility and Threshold Social Security, Information for people who receive supplemental security income (ssi) information for people on medicare. But that limit is rising in 2025, which means seniors who are working and collecting social.

Calculate payroll withholding 2025 JasmenBatool, The social security contribution thresholds are determined based on the development of all employees' gross salaries that are subject to germany’s social. (for 2025, checks got a 3.2%.

In 2025, the limit for most people is now $1,550 a month, up from 2025’s limit of $1,470 per month.